Global and national markets are ever changing and in order to grow or maintain market share, businesses must identify business trends and changes in customer behaviour before they disrupt profits. Market research should be an essential and ongoing part of business operations, not just during periods of crisis management.

In 2018 the following forces are shaping and changing consumer behaviour:

ADAPTIVE ENTREPRENEURS

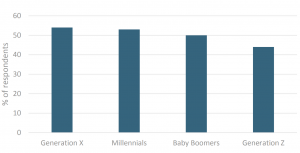

According to a global study by Euromonitor in 2017, 50% of respondents across all generations were aspiring to self-employment. This is indicative of an enormous shift away from traditional full-time jobs and towards more self-directed and flexible lifestyles. This development towards risk taking “Adaptive Entrepreneurs”, fuelled by stagnant wages, high youth unemployment rates and a change in personal values are causing delays in larger life goals, such as property purchases or children. The inspiring success stories of tech industry founders and the convenience of crowdfunding platforms are disrupting the economy, as “Adaptive Entrepreneurs” are no longer responding to traditional advertising strategies or job offers.

CALL OUT CULTURE

Two developments, (1) the increase in internet and social media usage and (2) consumers discovering and embracing their growing power, have given the “hashtag activism” movement momentum. Consumers feel empowered to speak up and show support for worthy causes. Brands and even governments are under increasing pressure as social responsibility and transparency are expected by increasingly opinionated consumers. A global Edelman survey in 2017 found that 51% of customers believed brands are able to solve more social problems than governments. Consumers are “voting with their wallets” and actively reviewing and pressuring brands online forcing companies to take a stance on current issues. This has forced brands toward greater direct customer interaction. Brands have to respond quickly and effectively, with some believing customer service to be the new marketing (Joy Bear).

% of Respondents Visiting or Updating Social Media at Least Once a Week

Source: Euromonitor International’s Global Consumer Trends Survey 2017

CLEAN LIVERS

Consumers’ strong sense of social responsibility increasingly motivates them to seek to provoke change through their consumption choices, thus fuelling trends. Trends include minimalism, veganism and abstinence. In response to these consumer trends we are seeing an increase in the development of non-alcoholic beverages, alcohol-free festivals and fitness nightclubs. Young consumers, in particular, are increasingly family-oriented and health conscious, seeking meaningful and healthy experiences, rather than ownership.

THE BORROWERS

With consumers increasingly choosing flexibility and freedom over possessions, Borrowers value access not ownership. This rejection of materialism in favour of meaningful experiences is increasingly impacting older generations. Combined with urbanisation and an associated decrease in average living space, it is leading to the emergence of innovative start-ups in the sharing economy, satisfying the increasing demand for sharing, swapping, renting and streaming.

IT’S IN THE DNA – I’M SO SPECIAL

With 25% of Americans stating they were planning to take a DNA test within the next 12 months, consumers’ growing curiosity about their genetic make-up and what it reveals about their ancestry, physiological traits and health risks are causing this infant industry to grow. The genetic testing industry has grown from USD$70million in 2015 to an expected USD$340 million by 2022. The greatest challenge facing the genetic testing industry is to convince potential customers of the effectiveness of testing methods and the security of their personal data.

VIEW IN MY ROOMERS

The emergence of more sophisticated technology and a growing demand for an immersive online shopping experience has brands globally exploring the benefits of augmented reality (AR). AR is believed to satisfy the “try before you buy” demand, giving online shoppers the convenience of shopping anywhere, at any time, with product information and reviews at their disposal, without having to sacrifice the benefits of a traditional in-store shopping experience

SLEUTHY SHOPPERS

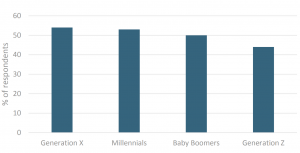

A crisis of trust between consumers and the motives of corporations engaged in mass-production is driving consumers to question marketing campaigns, brand images and business practices of companies of interest.

Sceptical consumers are increasingly demanding extensive evidence of labour, production and supply-chain practices to justify purchasing decisions. Proactive transparency and the provision of detailed proof and insight into business practices will foster trust toward the company and their products, helping to create a loyal customer base.

Respondents That Only Buy from Companies and Brands They Trust

Source: Euromonitor International Global Consumer Trends Survey 2017

I-DESIGNERS

A shift in consumer values from ownership towards experiences is disrupting purchasing patterns globally.

Consumers are aspiring to a meaningful involvement in the creation and production of their acquired possessions. Greater importance is attributed to the purchase itself, with personalisation creating more authenticity and greater value for the consumer. Recent advances in technology have enabled brands to provide customers with the opportunity to assume the role of a designer, adapting products to their taste whilst exercising their inner creativity. This is an essential step in creating a loyal customer base.

CO-LIVING

Skyrocketing real-estate prices in urban centres and the desire to share rather than to own is driving Millennials, as well as over-65s, to cohabitate with like-minded inhabitants, socialising, inspiring and living mortgage-free. Millennials, who are now outnumbering Generation X, now value freedom over ownership. The niche-trend of co-living is disrupting traditional real estate and fostering co-living business ventures, not just in residential but also in the corporate sector. This has created co-working spaces for individuals to interact with and inspire each other.

THE SURVIVORS

Even a decade after the Great Recession (2008-09) the gap between the rich and the poor remains , with 30 million households in developed markets surviving on a low income. The resulting food insecurity is giving rise to foodbanks, whilst the retail industry is responding with the creation of resale shops, grocery discounters and value-based retailers. These value-based retailers have proven resilient against the disruption of online shopping and are expanding faster than any retailer, inspiring traditional retailers to incorporate resale areas into their traditional business models.

Are you aware of key trends in your industry? Do you know how to take advantage of them?

Market Research helps you identify development opportunities so you can grow your business by staying ahead of your competitors. Be the business that sets industry standards and competitors look to for guidance.

Source: Euromonitor International

—

Be a first mover – book a free consultation today!